Machine learning based credit event modelling for the credit markets

Revealing the catalysts for event driven strategies Start Free Trial Start Free Trial

Start Free Trial

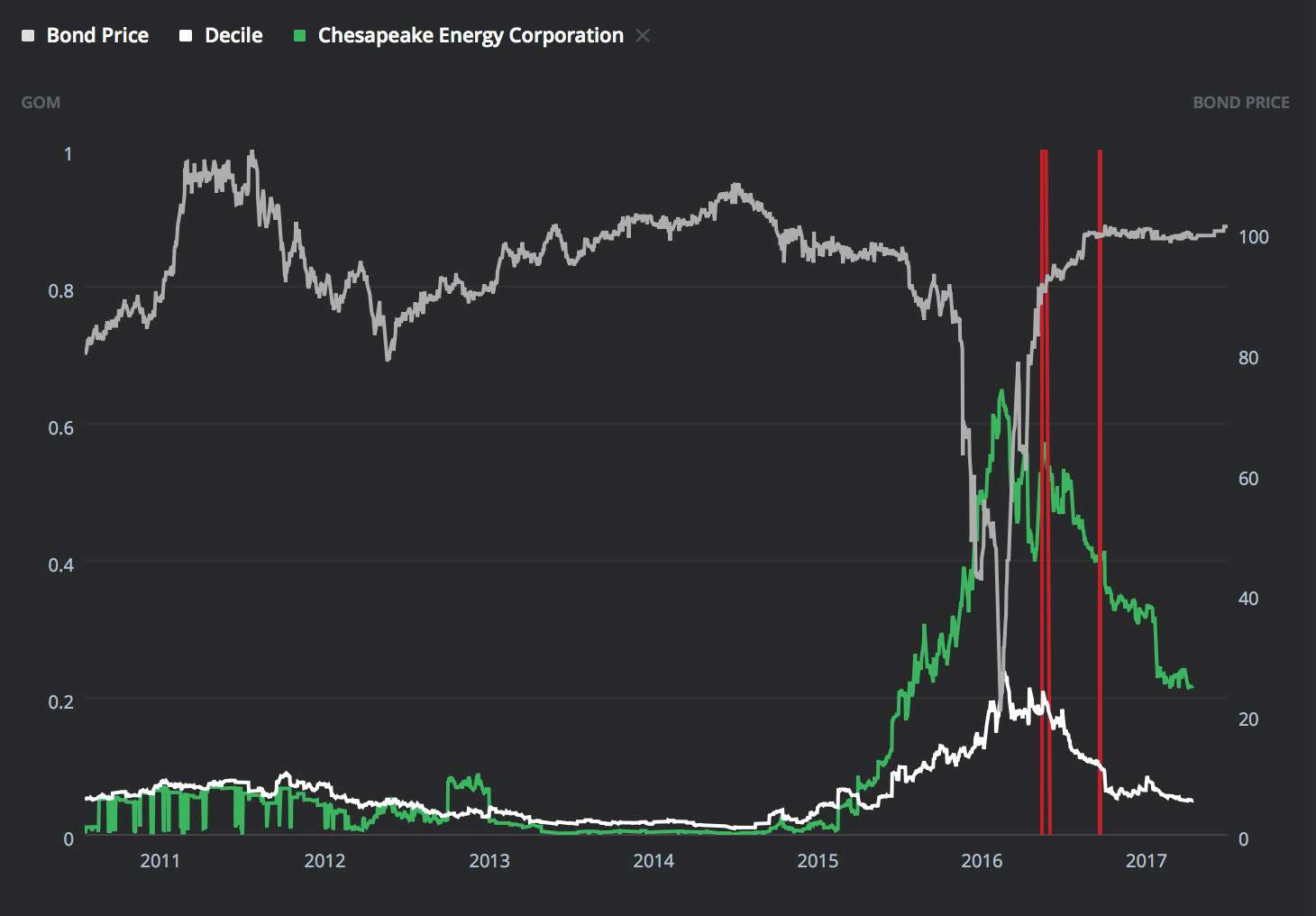

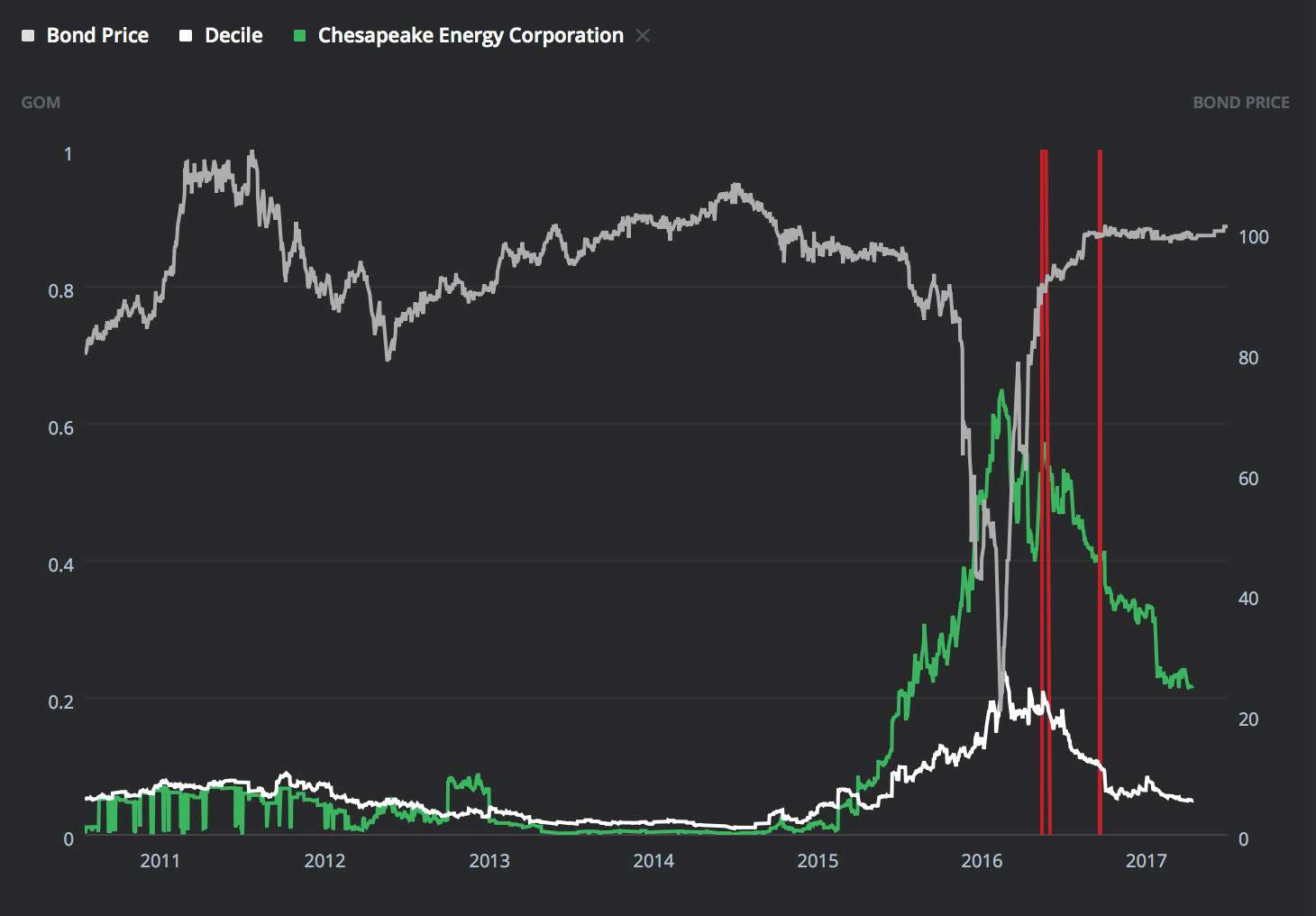

Default Prediction

Use the model with significantly higher predictive accuracy than traditional structural models. Uncover the default signal before it has been priced into the bond markets.

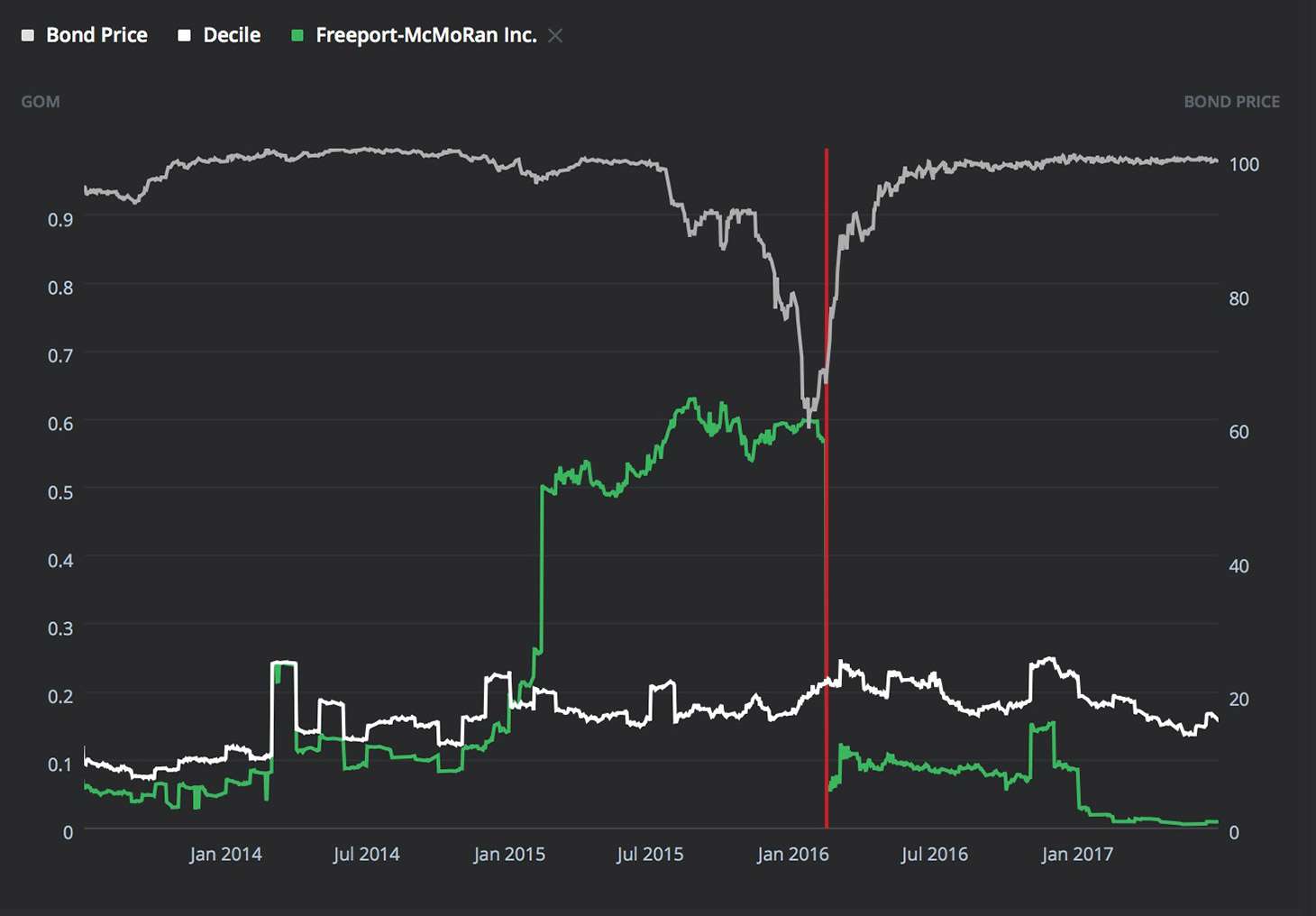

Downgrade Prediction

A novel model that uncovers firms at risk of rating downgrade from “investment grade” to “high yield”. Move before the bond price reflects the rating movement.

For funds with strict investment mandates, having an early warning of a downgrade event can enable a fund to act before having to realize a loss due to the downgrade event

Upgrade Prediction

Find those high yield issuers most likely to be upgraded to investment grade. Ideal for those looking to go long and benefit from possible price appreciation before the market has moved in this direction.

Case Study

What You Get

-

Dashboard

Intuitive to use and set up in minutes Manage and analyze your existing portfolios Live alerts for SEC filings -

Data Feed

Daily end of day risk scores Easy to link and integrate to existing data bases -

Reports

Set your own criteria for alerts Receive alerts via email once events triggered Time efficient way to screen the market